A dive into financial and mental wellbeing with Beyond Blue

In our August Know Your Customers + Communities – Community of Practice, we heard from Beyond Blue and how their Services Guide for Financial and Mental wellbeing can be used by energy & water customer teams to better support customers experiencing financial and mental health stress.

Beyond Blue is an Australian, not-for-profit organisation, whose vision is to help all people in Australia achieve their best possible mental health. Representing them was Irene Verins, their Wellness and Prevention Lead. She oversees development of research relating to Financial and Mental Wellbeing, and the design of tools and resources to support the community. Irene also oversees the Parenting and Mental Health portfolio.

Irene explained the purpose of the session was two-fold:

- to introduce Beyond Blue’s research, tools and resources and explore how they might be useful to your sector

- to build understanding between the energy, water and mental health services sectors.

What is financial and mental wellbeing and what does the research tell us about it?

Financial wellbeing is being able to meet current and ongoing expenses and commitments, being financially comfortable to be able to make choices to allow one to enjoy life, feeling secure about the financial future and having resilience to cope with financial adversity.

While financial challenges refers to any financial circumstances, thoughts and feelings that may negatively impact financial wellbeing (for example financial hardship, debt, unemployment, loss of income, low income)

In turn, mental wellbeing reflects a state of wellbeing in which every individual realises their own potential, can cope with the normal stresses of life, can work productively and fruitfully, and is able to make a contribution to their community.

While mental health challenges is an umbrella term that covers diagnosed mental health conditions, as well as any other mental health issues that may negatively impact mental health but may not meet the criteria for a diagnosed illness.

Beyond Blue’s recent Money and Mental Health Report found people experiencing financial challenges were at least twice as likely to experience mental health challenges and vice versa. We found that those people most affected by financial and mental challenges were:

- young people,

- women,

- First Nations, and

- small business owners.

What are factors that influence financial and mental wellbeing?

- Relationships – People who felt they had no one to lean on are more likely to experience financial and mental health challenges. And withdrawal from community and social interactions is a common response to financial challenges.

- Life transitions – Young adults transition from school to university or their first-time job, transitioning out of work and into retirement. If support is not available, transitions can quickly become risky moments.

- Cultural narratives about success – often lead to expectations on what being financially stable symbolises. The environment you live in, or the expectations surrounding your circumstance may create a culture that contributes to self-blame or feeling ashamed. Job and income loss may lead to shame that you are not meeting expectations of managing your financial position and your family responsibilities. This was prominent for small business owners.

- Stigma – plays a significant role in both mental and financial health and inhibits help-seeking. So often we hear that people feel enormous shame when they talk about financial difficulties, and this can deter them from seeking help when they need it most.

- Adverse life events – are often outside your control and can be coupled with trauma. These may include divorce, separation, becoming widowed, job loss and family violence. These situations can lead to unexpected and rapid changes in income and financial stability.

This is important because a recent unpublished report has found that 37% of Australians reported that cost of living was the issues having the greatest negative impact on their mental health.

How can the Services Guide for Financial and Mental wellbeing help?

Developed in partnership with Financial Counselling Australia, this Guide provides practical advice on how services from both energy + water sectors, can provide greater support to customers.

We are not asking the energy and water sectors to become mental health counsellors or financial councillors. The aim of this Guide is to build the awareness and capability of energy + water sectors to work with mental health services, showing how they can both work more closely together. This flow on effect of bringing sectors together will drive action on support and referral options.

The Guide will help you:

- Depict signs & behaviors of people in financial or mental hardship

- Apply models and approaches in assessing hardship

- Drive action on support and referral options.

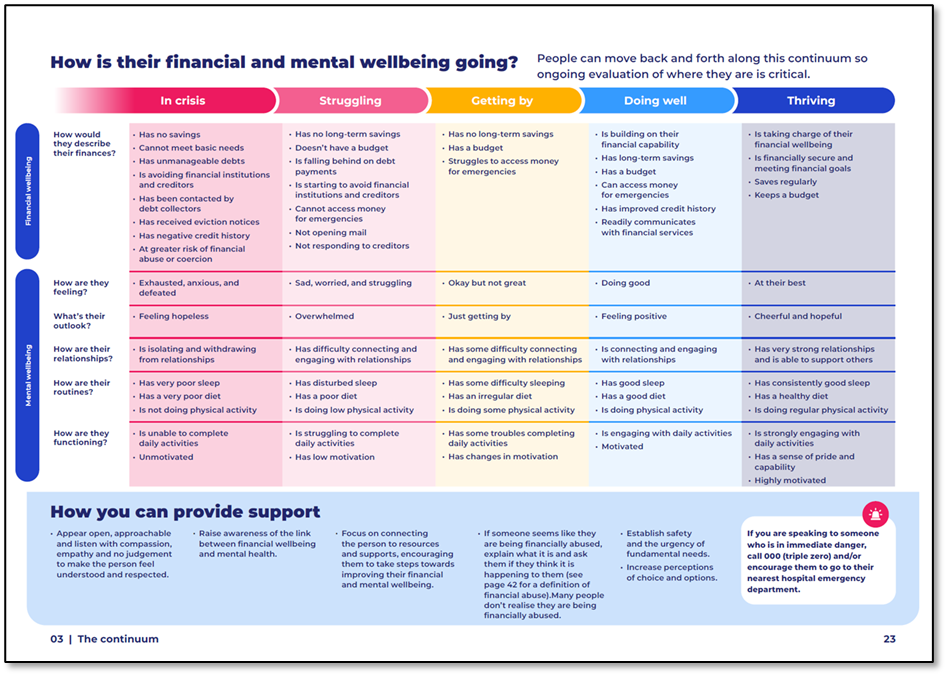

A key tool in the Guide that you can have on your desk as a reference when you are meeting with clients is this continuum. It will help you evaluate a person’s financial and mental wellbeing. It starts with ‘In crisis’ and moves through stages until we get to ‘Thriving’.

Financial and mental wellbeing journeys are non-linear, meaning they can shift and change over time. That’s why managing financial and mental wellbeing together is important at all stages of the continuum. Whichever stage is identified by a customer along the continuum, there are broad actions and support you can provide in subsequent pages of the services guide.

Watch the ‘Support customers with financial & mental wellbeing’ session

If you would like to watch the Know Your Customers + Communities – Financial and mental wellbeing session that explored inclusion, you can watch the recorded session here.

About this event

This event was part of the Know Your Customers + Communities Community of Practice dedicated to building capability around robust and fit-for-purpose customer, community, and stakeholder engagement, and building organisational cultures that value the customer voice in decision making.

Know Your Customers + Communities is a collaboration with between the Energy Charter and Water Services Association of Australia under our Collaboration Memo of Understanding (MoU).

To become a regular member of this Community of Practice, please contact Bec Jolly, Director Collaboration at bec.jolly@theenergycharter.com.au.